Investment Strategies that Can Boost Your Returns - Financial Independence

Please note: This post may contain affiliate links. See our disclosure to learn more.

Remote Jobs > Online Businesses > Investment Income > Investment Strategies the Can Boost Your Returns

Many people refer to “retirement” as the time when they actually achieve “freedom.” However, this does not have to be the case. Financial freedom can come sooner than retirement, if you are aware of the different methods that exist to get you there. The “Financial Independence, Retire Early” (FIRE) movement was created for helping people achieve exactly that result.

There are other investment strategies that could help you reach financial independence even quicker - however, many of them require knowing more intermediate and advanced investment methods. I'll briefly share some of these methods to help you understand the concepts better in this article, but do keep in mind that I tried my best to make the concepts as understandable as possible to the average person, even though experienced investors may also find it useful.

Note: While this article is specifically written to inform people on types of strategies that could be used in an investment portfolio, it should not be considered “investment advice” for your specific situation - as we have no idea what your personal investment objectives are, what your risk tolerances are, or what your future needs for capital are - among other things - to be able to give you advice on whether any of these strategies are suitable for your personal investments. That being said, you may find the information below to be helpful in your own decision making process.

Photo by Andrea Piacquadio from Pexels

1. Buy and Hold - Long Term Strategy (the EASIEST strategy)

This is the method that FIRE generally recommends because it focuses on wealth protection. When you have a portfolio of stocks/bonds/etc. that you have no intention of selling or cashing in, then you have a Long Term Strategy. They are simply an investment - something you paid for at one point in your life but no longer allow yourself access to withdraw. One way to learn about everything that this entails is by reading our article on the FIRE method. However, in the end, the message is simple: You must plant a seed, water it, and never dig it up.

Dividends & Capital Appreciation

When you buy a share of stock you are actually buying a small piece of ownership in the company. Thus, when the company makes money, you also earn a share of their profits. Sometimes the company holds onto those profits and the value of your stock increases because the company is now worth more money - this is called Capital Appreciation. Capital Appreciation is not distributed to you, it just raises the value of your investment portfolio. Alternatively, the company can pay out the profits to its shareholders, like you, as a payment called a “dividend.” Think of a dividend like a small paycheck.

Interest Earned

When you buy a bond you are actually lending money to a company. So, just like when you borrow money in the form of a loan or mortgage, the company will owe you interest on that loan on a regular basis. Additionally, they will eventually owe you your money back as well. However, you can also look at these interest payments as small paychecks as well.

The capital appreciation, dividends, and interest that you receive from your investments have the power to replace the income that you toil to earn at work. In most years, your investments will earn interest, dividends, and capital appreciation - increasing the value of your investments year-after-year. The dividends and interest that your investments have earned for you could be considered the “fruit of your investments” - instead of the “fruit of your labor.” Once your investments are large enough, you can begin picking that fruit.

There are two things that you can do with this Fruit: You can withdraw it to use as an income source, or you can reinvest it to help your investments grow quicker.

Reinvestment is extremely powerful and the secret to how some people who earn less than $40,000 per year can end up with millions in retirement.

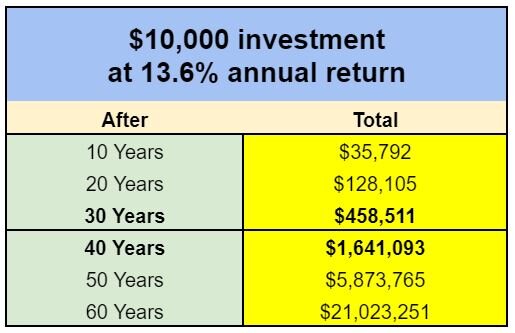

To put it mildly, if you invested $10,000 into the S&P 500 at the beginning of 2010 and left it there until the beginning of 2020, then it would be worth $35,792. This is because the average return of the S&P 500 was 13.6% over that 10 year period. That's 13.6% each year, for 10 years. It could grow much larger if left in longer, however most people only end up investing for about 10-30 years as they do not begin investing in their early life.

* With this strategy, financial freedom is usually achieved in the later years of life.

The FIRE Method

However, the FIRE method was developed to encourage people to cut expenses and invest the difference to accelerate the growth. This can make an “earlier retirement” possible, however it depends greatly on two important details:

the fact that you do have the means to cut your expenses and/or increase your investment amount. That is not always possible for everyone.

Additionally, Long Term Strategies generally don’t have any protection from major market drops just prior, or during, the retirement years.

We address some possible solutions to these issues in this article.

You can learn about a few other Long Term Strategies, including Dollar Cost Averaging, on this Investopedia page. However, don’t forget to read the the FIRE Movement article if you haven’t already done so!

2. Day Trading Strategy (a RISKY strategy)

If a person does not have any additional expenses to cut, or cannot find other ways to increase their income, they may begin to consider Day Trading as a viable option. Some others, who have already cut expenses, might look at Day Trading as a method of increasing their annual return rate as well. Either way, people who are managing their own investments generally consider some type of Day Trading Strategy at one point or another.

What is Day Trading?

When a person decides to follow investments on a day-to-day basis and buy or sell them based on minute-to-minute, daily, weekly, or monthly changes, they are considered “Day Traders.” When trading stocks or bonds on a daily basis, you may end up making extra profits or extra losses. Of course, most people focus on the potential for extra profits, but forget about the potentially damaging extra losses. Day Trading is used primarily for rapid growth.

Some believe Day Trading is akin to gambling while others feel that their knowledge of a company or the market in general will give them an edge. Either way, regardless of whether you are playing the slot machines, sitting at a poker table, or Day Trading there tend to be more losers than winners. Over the long term, it seems that nearly 80% of day traders end up losing all - or most - of their money, due mostly to Emotional Intelligence & Investor Behavior (see the study: [pdf]).

This is similar to the well known casino axiom, “the house always wins.”

To succeed in day trading, you need to have “a tremendous respect for risk.” After over 13 years of trading, I can assure you that I’ve lost my shirt quite a few times in the beginning - and lost tens of thousands of dollars on some of these trades. However, over time, I’ve learned to use a strategy to limit the amount that I would use for my day trading activities - and that ended up saving me in the long run. All of my friends who are day traders have a very similar story.

* Roughly 80% of Day Traders end up penniless, but about 20% retire early.

My recommendation: Do not make day trading your primary strategy. If you desire to do it, limit it to a small amount of your total money. Once you start doing it, you’ll realize that there are dozens, if not hundreds, of different strategies that you can use to potentially increase your returns (some of which I mention at the bottom of this article).

If this is something that you intend to pursue, I would recommend checking out “How to Day Trade for a Living: A Beginner’s Guide” before you get started.

Photo by Nik Shuliahin on Unsplash

3. Combination Strategy (a BALANCED strategy)

You can also combine a Long Term Strategy with a Day Trading Strategy to reduce the risk of the Day Trading Strategy and potentially increase the returns of the Long Term Strategy.

First, set up your long term strategy, then - instead of reinvesting your gains - opt to use the dividends and interest that you receive from it for day trading. What this does is limit your losses to only the amount that you’ve gained during that period.

However, if you lose continuously in your Day Trading Strategy, it will also effectively destroy the power of compounding that a regular Long Term Strategy would have (you may not end up with much - if any - growth in your portfolio over time).

For example, if you had a $100,000 investment and you earned $5,000 in dividends and interest over the year (a 5% return rate), you could take the $5,000 and use it for day trading. If you lose that money, your primary investment of $100,000 was not put at risk in the Day Trading Strategy so you can still expect more returns to try again next year. However, if your Day Trading Strategy is successful, you could end up with far more than the $5,000.

Once you’ve done that, you could re-deposit the $5,000 that you took out of your Long Term Strategy and reinvest it as-if you never took it out to begin with. You can then use the remainder of your profits to fuel more Day Trading Strategies, reward yourself in some other personal way, or reinvest it into your Long Term Strategy as well. Either way, this method is far superior than simply using a Day Trading Strategy as it would prevent 80% of Day Traders from losing all of their money.

* With this strategy, more people are able to retire earlier.

Photo by Mathieu Stern on Unsplash

4. Synthetic Indexed Annuity Strategy (an ADVANCED strategy)

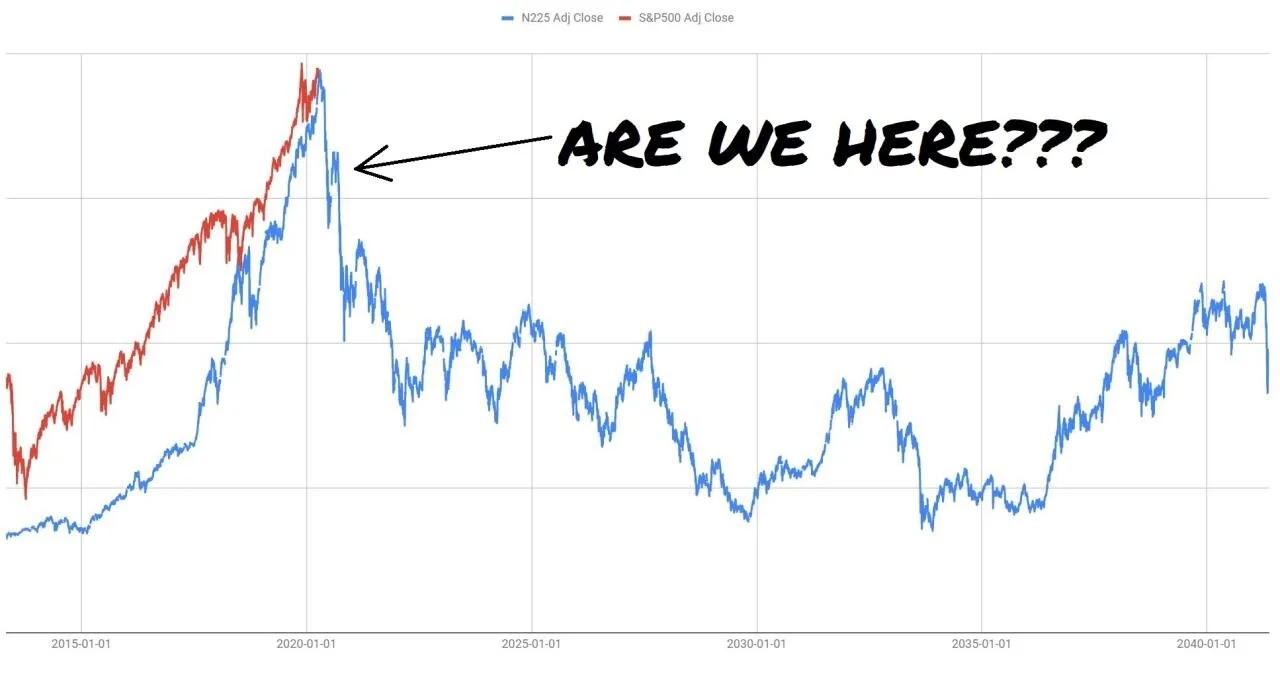

The other major drawback of the Long Term Strategy is that you are subject to market slumps - or major corrections - like those that occurred in the Great Depression of 1929, the 1987 Crash, the Dotcom Crash of 1999, the Great Recession of 2008, and the Coronavirus Recession of 2020.

These types of downturns can have serious consequences to your investment portfolio - and it could take many years to recuperate from them. This may not be an issue if you are not yet nearing retirement, but if you are nearing retirement - or already in retirement - and no longer have time to wait for it to rebound before drawing out funds - it could be fairly catastrophic to the quality of your life in retirement.

So, how could you prevent this type of loss from occurring prior to your retirement? Possibly by altering the Combination Strategy a bit by using an Indexed Annuity!

What is an Annuity?

An “annuity” is very much like a self-made pension plan. If you purchase an annuity, you are essentially giving your money to a company in exchange for a guaranteed amount of monthly or annual income.

For example, you may be able to purchase an annuity for $500,000 that would pay out $2,946 every single month for 30 years - for a total payout of $1,060,560 by the end of the 30 years. Some will pay out for as long as you are still alive (eliminating the problem that you might live to be 180 years old).

The total ends up being more than the $500,000 because the company typically invests your money into U.S. Treasury Bonds, or a highly rated Investment Grade Bond Fund of some type, during that period of time. This helps keep the investment quite safe while earning a small amount of interest over that period (perhaps 3-6%) and increasing the total amount that you receive.

Thus, if you wanted to guarantee that your investments didn’t suddenly drop prior to retirement, an annuity could probably be a good option.

Indexed Annuity

When I was working as a Financial Advisor, I came across a product called an “Indexed Annuity.” It was interesting to me because it guaranteed income growth every year, and it was even able to get returns that were close to actual market returns. That is, you were guaranteed at least 3% return every year, even during downturns, but could also receive much higher returns when the stock market went up!

With this one, you could choose to have your money invested into a stock or bond market index instead of U.S. Treasuries - such as the S&P 500 Stock Market Index (which returned an average of 13.6% over the 2010-2020 period!).

So, by choosing an “Indexed Annuity,” you could end up investing the same $500,000 and receiving monthly payments of $5,460 over the course of 30 years instead of $2,946 - for a total payout of $1,965,600.

Which index you choose could have a significant impact on your quality of your life during retirement. Either way, a guaranteed income payment removes the concern of a market drop in retirement - while a return, that is close to the market return, allows for continued rapid growth when the market increases. Win win, as far as I am concerned!

How to create a Synthetic Indexed Annuity

While it is much easier to allow a company to manage your indexed annuity for you (we recommend Ryan Lay at Lighthouse Financial), it is also possible to recreate a synthetic indexed annuity for yourself.

When I first learned about Indexed Annuities, I asked myself: "How could they guarantee an income in years that the market dropped AND still give you close to the market return in years that the market went up?"

Little did I know, this was perhaps the biggest piece of the investment puzzle for me - and it would end up becoming the basis for the investment strategy that I adopted over the rest of my lifetime.

As Indexed Annuities are guaranteed payouts, I had to ask myself two questions:

how were they able to guarantee that you wouldn’t lose money - even if the stock market dropped, and, at the same time,

how were they able to provide a return that was close to the market return if the stock market increased.

Question 1

So, how do they guarantee that there are no losses? Well, provided that your portfolio is composed of a good diversification of very safe investments - such as U.S. Treasury Bonds, TIPS (Treasury Inflation Protected Securities), or AAA Rated Corporate Bonds - you would have the closest thing that you could have to a risk-free portfolio (it is not risk-free, but it’s close). Additionally, you’d still be receiving some type of interest payment each year - because you are lending money to either the government or some companies.

So, while it’s not guaranteed in the same way as an annuity (as the company selling that product is taking a risk similar to an insurance company - and would therefore need to cover your losses if it did occur), this synthetic annuity is fairly close on point number one.

Some alternatives that you could choose - that aren’t quite as safe - are a AA Rated, A Rated, or BBB Rated Investment Grade Bond Index, or possibly even a Preferred Stock Index. Although, doing so puts your portfolio at a higher risk of capital depreciation during market correction years so we would not recommend doing that if you are closer to retirement.

One other alternative would be to use a market-neutral fund (an equally weighted long-short fund that is properly hedged) as this type of fund would not be dependent on market movements at all. Feel free to ask me questions about these options in the comments section below - or on our FIRE: Finance & Investment Club group on Facebook.

Question 2

So, how do they offer market-like returns without putting the entire portfolio at risk? For that, you’d need to understand what stock options are - and wow, it took me awhile to find a short video that explained it well and wasn’t super dry! So, if you don’t know what they are yet, check out this 3 minute video.

Now that you understand what a Call Option is, we can proceed to explain how they are used in Indexed Annuities.

Assuming that your safe investments, from Question 1, begin paying you income in the form of interest and/or dividends, you can then use all, or part, of that income to purchase call options on any particular index that you would like, including the S&P 500 Index [Ticker: SPY].

Call options cost money, but they give you the right to basically purchase the stock market index at today’s price, except at some other time in the future (like next year) in exchange for a fee (called the “option premium”).

Example: I have a $100,000 investment that earns 6% in interest/dividends per year. At the end of the year, I still have $100,000 invested, but I also have $6,000 in cash sitting in my account from the interest and dividend payments. I can then use that $6,000 to purchase 3 call options* on SPY, which is currently trading at $380/share (3 call options = 300 shares). If the S&P 500 stock market index increases by 15% over the following year, my earnings would be 300 shares times 15% of 380 = $17,100. Thus, I’ve turned my $6,000 in interest and dividends into $17,100. (*In reality, I would likely purchase a 50-point “Bull Call Spread” to capture about $15,000 in profits - and the return would be “Close-to” the stock market return).

The net effect is that you would have recreated the Indexed Annuity on your own: your primary investment is secured in relatively safe investments AND you have the potential to earn close to the market’s returns without having the same amount of risk.

5. Synthetic Indexed Annuity Strategy PART 2 (an ADVANCED strategy)

I personally enjoy building my Long Term Strategy component / Synthetic Annuity by using a diversification of a few low-expense Preferred Stock ETF’s. To learn why this is an attractive option, and even get a few recommendations, check out this Benzinga article. However, the main attractions for me are that they provide a higher dividend yield than bonds and are much more stable than stocks.

Now to blow your mind…

Provided that you can now re-create a synthetic annuity by using your interest and dividends to purchase call options on the market, why couldn’t you invest in something completely different instead?

For example, you could invest them into super high-risk speculative investments, such as options on specific high-growth companies, futures contracts, forex (foreign exchange markets), or even cryptocurrency if you really felt like it.

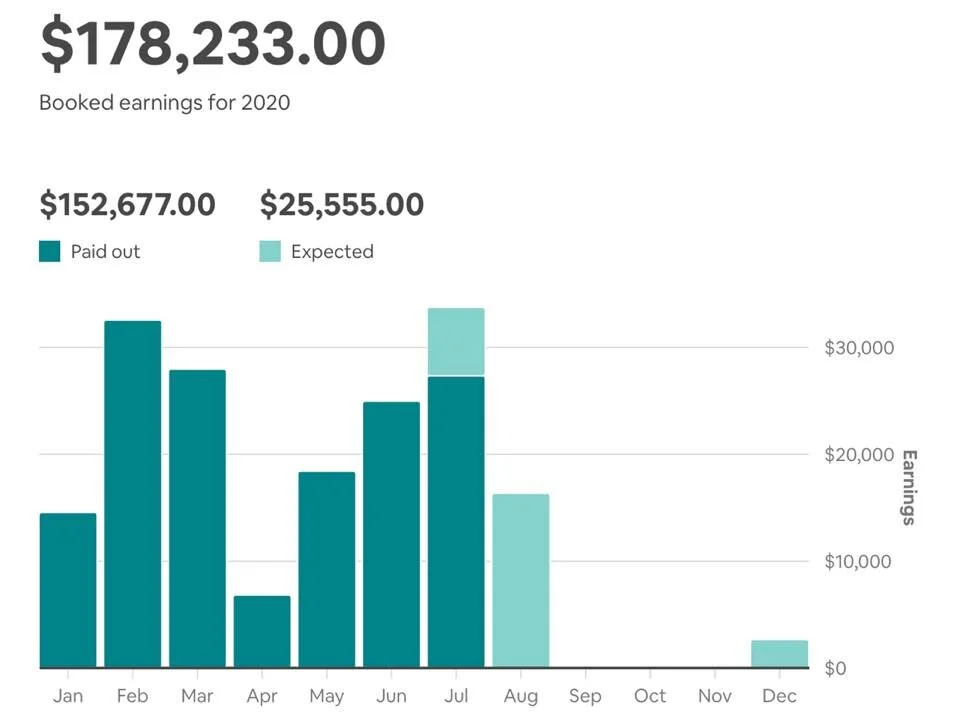

If these end up failing, then your initial investment account is still there and all that you’ve lost is the quarterly or annual dividends and interest that you’ve accumulated - just as in any of the other Combined Strategies mentioned in this article. If they pay off, it could be a windfall. For example, the Oil-Gasoline Crack Spread that I’ve been trading for over 10 years has an average return of over 80% per year! (see link below for more info)

The net effect here is that you’ve recreated the indexed annuity with a few alterations - and instead of settling for the returns that come from the stock market, you can reinvest those gains into other strategies that are far more risky - but could deliver 5-20 years worth of returns in a single year instead.

Investment Strategies that Can Boost Your Returns

“A portfolio manager once told me that half the research on my desk was a complete waste of time. ‘Figure out which half is garbage and you’ve just doubled your productivity,’ he advised.

His point was that most research is backward-looking rather than predictive. Reading obscure financial information may look and feel like productive work, but most of this content has little chance of leading to better results.” - CFA Institute - How to Read Financial News: Tips from Portfolio Managers

These are my favorite 5 trading strategies, and the ones I typically use in my investment portfolio with the Synthetic Indexed Annuity Strategy:

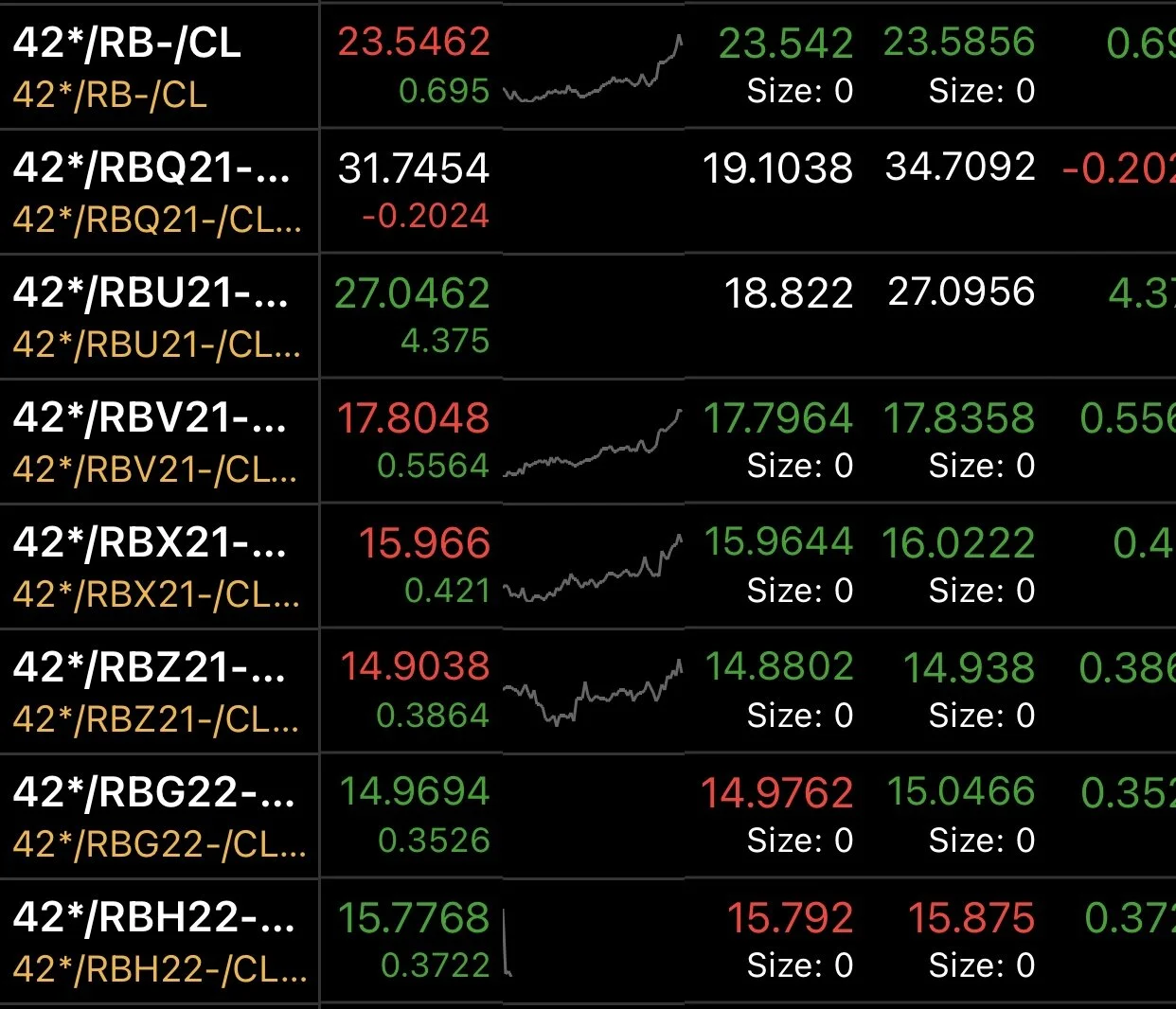

The Oil-Gasoline Crack Spread (Futures Contracts)

This is a mean-reverting inter-commodity spread that is essentially the market price for the cost of refining gasoline from crude oil. It has some characteristics that make it very unique and attractive. It requires the use of futures contracts on Crude Oil and RBOB Gasoline on a 1:1 ratio and typically only requires $1,250 to $2,500 of investment to open a trade. However, the net required margin is tiny compared to the results - which can be over 300% in a matter of weeks.

Before you attempt to trade the Oil-Gas Crack Spread:

Selling Put and Call Options to Enter & Exit Positions

Instead of paying money to purchase or sell shares of stock, it is far more rewarding to get paid to let people sell them to you or buy them from you. It doesn’t sound any different, but it can substantially increase your returns!

For general information on these strategies, see:

Selling Put Options to effectively Buy StocksSelling Covered Call Options to effectively Sell Stocks

For more in-depth information, walk-throughs, and examples, check out The Complete Guide to Option Selling.

Negative News Events & Volatility Spikes

When a Company that I believe in - because it had a lot of potential to grow - ends up having a Negative News Event - I ask myself if the stock dropped relative to how I expected, or did it drop much too far? Occasionally, these news events are mostly meaningless - and will not effect the company much at all, so a major 5-10% drawdown on a Negative News Event that might impact overall profit by less than 1-2% seems excessive. If I believe the drop has been overblown, I typically purchase call options - or bull call spreads - on that company’s stock as soon as possible. If I’m correct, the chances of a quick rebound are usually very high.

Market Neutral Trades: Pairs Trading & Long-Short Hedged

These types of trades are based off of equally weighted sides: one “long” and one “short.” What this means is that you’ve purchased one stock hoping that it will go up in value and you’ve “shorted” a different stock with the expectation that it will either go down in value or simply not increase as much as the other stock. You can learn the general concept on this page: Market-Neutral Fund or learn it in much more detail by reading Alpha Trading or Market Neutral Arbitrage.

Discounted Closed-End Fund Arbitrage

Closed-End Fund Arbitrage is a specific type of Pairs Trade. A Closed-End Fund is similar to a Mutual Fund or ETF, but instead of always trading at the value of the stocks and bonds that it owns it actually is allowed to trade freely at any price. Thus, these funds typically trade at a discount or a premium from their actual value. So, by looking at what shares the closed end fund owns, you can effectively buy an underpriced closed-end fund and short the corresponding stocks that it owns that are fairly priced. If you keep this hedge on until the discount disappears - or reduces, you’ve effectively captured some fairly risk-free profit.

Learn more by checking out these pages:

- Statistical arbitrage in closed-end funds

- Closed End Fund Arbitrage

- Wider Closed-End Fund Discounts

Conclusion & Contact

And that is it for this article. If you would like to discuss any of these strategies with me in a conference call, please refer to our Nomadic Financial Advisor page. Alternatively, you can always post a comment at the bottom of this article or join our FIRE: Finance & Investment Club group on Facebook.

In the Next Article

Continuing on with our series, we will be focusing on how to decrease the amount of money that you need in retirement by simply changing your retirement location.

For example, did you know that you could retire on less than half of what is required by simply moving out of New York City and into a smaller US town?

Additionally, you could retire on less than 25% of what you think you need by moving to a foreign country - while keeping the same quality of lifestyle. We know that it works because we’ve been doing exactly that!

Check out that information on this page - because it can completely change the game!

FAQ’s

What specific investment strategies are recommended for someone just starting on their path to financial independence?

For beginners, it's advisable to start with low-cost index funds that track the market, as they offer diversification and lower risk compared to individual stocks. Setting up an automatic investment plan can also help in building discipline in saving and investing regularly.

How can an investor manage risk when implementing these investment strategies?

Risk management is crucial and can be achieved through diversification across different asset classes, rebalancing the portfolio periodically to maintain the desired asset allocation, and using stop-loss orders to limit potential losses.

What role does tax planning play in enhancing investment returns for financial independence?

Tax planning is essential as it can significantly affect net returns. Utilizing tax-advantaged accounts like IRAs or 401(k)s, taking advantage of long-term capital gains tax rates, and considering tax-loss harvesting are strategies that can help in reducing tax liability and improving overall investment returns.

(1) Investment Strategies that Can Boost Your Returns - Financial .... https://eatwanderexplore.com/blog/investment-strategies-that-can-boost-your-returns-financial-independence.

(2) Investment Income Made Easy - Live on Residual Income. https://eatwanderexplore.com/blog/investment-income-made-easy-a-step-by-step-guide.

(3) 10 Financial Strategies to Reach Your Money Goals - SmartAsset. https://smartasset.com/financial-advisor/financial-strategy.

Thank you VERY much for reading our article. We actually created this website to help people reach financial independence. Did you know that by having a remote job and traveling endlessly, or living in a country that has low costs of living, you can actually reach retirement quicker? Plus, retirement abroad is up to 75 percent cheaper as well! Learn more by exploring our website: EatWanderExplore and REmotiFIRE.

See our Thank You page to sign up for our free weekly newsletter - you’ll receive only 1 email per week letting you know about our latest travel articles, remote-work life, and amazingly affordable destinations!

Found this post useful? Buy us a coffee to help support this site’s running costs OR share this article with a friend.

![Tech Elevator Demystified: Reviews, Legitimacy, and Winning Alternatives [2024]](https://images.squarespace-cdn.com/content/v1/5a028c7bbce1766d207a8a6f/1707008329038-96GH4TTYZATP6N3WDWXR/tech_elevator.png)

![Cracking the Code: Coding Dojo Reviews, Legitimacy Check, and Top Alternatives [2024]](https://images.squarespace-cdn.com/content/v1/5a028c7bbce1766d207a8a6f/1707007756149-VSJNN2PHHX2RWK6RSVQM/coding_dojo.png)

![App Academy Unveiled: Reviews, Legitimacy Check, and Top Alternatives [2024]](https://images.squarespace-cdn.com/content/v1/5a028c7bbce1766d207a8a6f/1707008090320-IUIIV4T416FP5ILRGK5W/app_academy.png)

![CareerFoundry Decoded: Reviews, Legitimacy, and the Best Alternatives [2024]](https://images.squarespace-cdn.com/content/v1/5a028c7bbce1766d207a8a6f/1707008030234-CZTE1805JUCU2M2GK7RO/careerfoundry.png)