The Oil-Gasoline Crack Spread: An Advanced Investment Strategy

Please note: This post may contain affiliate links. See our disclosure to learn more.

Remote Jobs > Online Businesses > Investment Income > The Oil-Gasoline Crack Spread

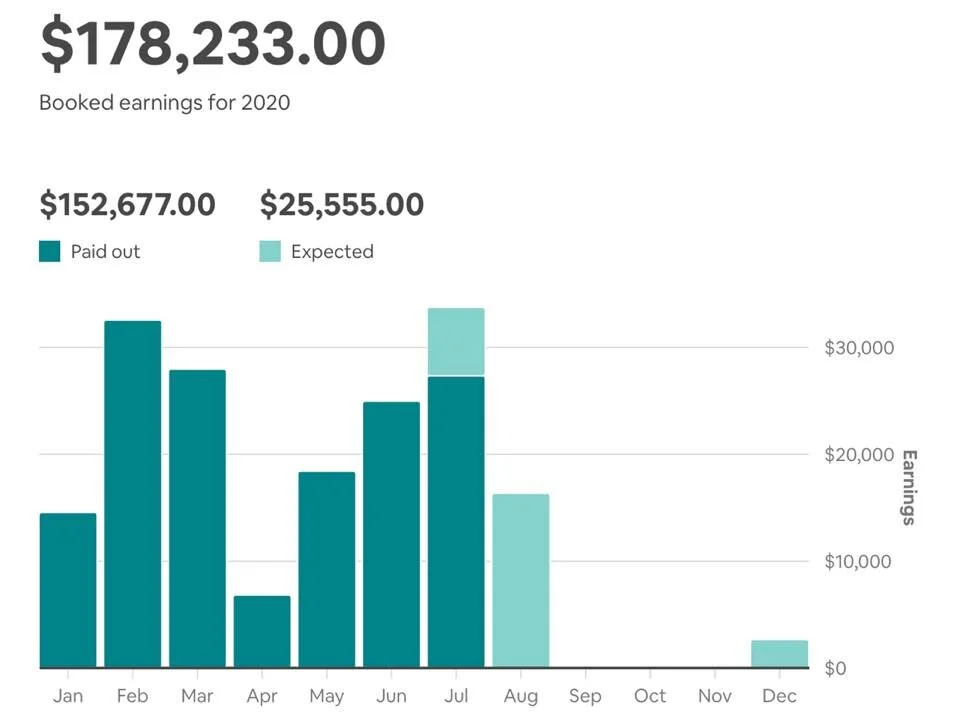

The returns from this trade alone have been enough to pay for all of my life’s expenses while traveling the world continuously since early 2018. When we started traveling, we planned to only travel the world for a single year. You see, I had been offered to manage a portfolio of $50 million using the exact trade that I’m about to share with you, and they were offering me 30% of the returns. It was huge, and I wanted to take the offer.

However, simply continuing to trade this spread on our own has made it possible for us to keep going without the need for any additional job or income. So, as our worldview had changed after traveling the world, we decided not to take the offer as we feel that we already have “enough”. It is really remarkable how dependable the trade has been - mainly because refinement companies must keep the price in check or they'd go out of business due to low margins.

Since I started trading this spread in 2010, I’ve really only needed to do this 1-2 times per year to be financially free - something it took me nearly 9 years to realize. That's because I've been making a few thousand, on average, on each Oil-Gasoline Crack Spread (OGCS) that I trade. For every $1,250-$2,500 that I invest on this spread, I've earned an additional $1,500-$3,000 - and I typically grab about 20+ of them at a time meaning that my profits are usually $30,000 to $60,000 each time. Yes, I could have managed over 2,000 spreads, but that’s a different life that we don’t talk about anymore.

It’s easy, but it’s not so easy. Once you understand it, it’s almost free money as you know the refineries will be working - indirectly - to make sure that your trades are profitable. Plus, it’s available to just about everyone all around the world. Now I'm showing other people how to do it and the service is even free for the first month.

I think of it like a literal money tree - except that there's a pack of wolves that has made their den at the base of that tree. I can’t be too greedy, but if I wait until the the pack has left, there’s a lot of free money! Futures are risky, so you’d need to understand the risks before trading this spread. However, I’ve learned a lot of tricks over the years that - when used together - end up nearly eliminating all of that risk.

A few other oil traders use this spread to make money too, but it's not very well known to general investors. So, when I mentioned it in an online group there were a number of people who were interested in learning more about it. Thus, I created this article to share a bit more information about it.

To make it even easier, I created the Getting Started Guide to make sure that everyone is doing it correctly.

“I just wanted to say thank you for sharing your knowledge and time so generously, and for guiding me through my first successful Crack-Spread trade. Your patient explanations and insightful projections helped me immensely. Before I found your service I was trying to trade in the Crypto markets but I was finding that, even with careful risk management, I was losing more than I was winning. After my first Crack-Spread trade I have recouped my losses from Crypto trading and covered my extra Christmas expenses. And that was just my first! Now I am raising funds in anticipation of your next signal so that I can hold a larger position next time around. I don’t want to be dramatic here, but I think it’s just stating a fact to say that this investment strategy has already changed my life.” - Aaron R.

So, what exactly is this Oil-Gasoline Crack Spread? And how can it earn me so much money?

Oil Refineries and the Crack Spread

Photo by Tasos Mansour on Unsplash

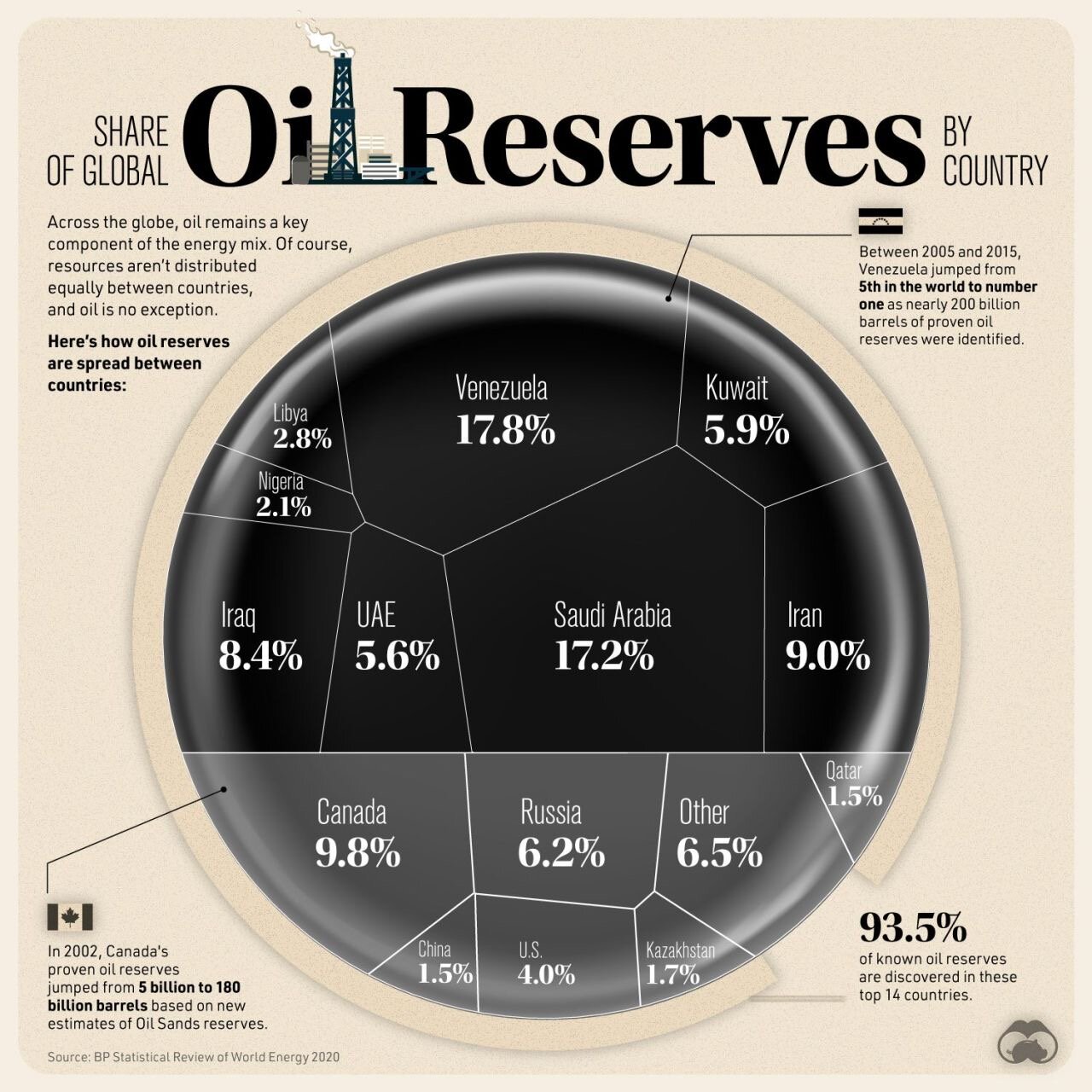

Well, Oil Exploration & Drilling companies find and drill for crude oil. That’s what they do. Oil Refineries, on the other hand, buy that crude oil and “refine” it into things like gasoline and distillates (distillates are diesel fuel, jet fuel, and heating oil) through a process called “cracking”. That is why this is called the “Crack Spread”. It is based on the refinement process of crude oil.

CRACK! With the snap of your fingers this crude oil turns into gasoline! Not exactly like that, but yeah, that's what they do.

After they have made the gasoline and distillates, the refineries need to sell these products to make a profit. Any company’s Gross Profit is the revenue that they receive from selling their products minus the cost of the items that they had to use in order to make those products (known in business as the “cost of goods sold”), and an Oil Refinery is no different. Their “cost of goods sold” is simply the cost of the crude oil. Their selling price is the amount of money that they receive for the gasoline and distillates that they sell.

Example: Imagine that a barrel of Crude Oil costs $62 and a barrel of Gasoline costs $85. Simple math would show that the difference between the two is $23 per barrel. That’s how much the refinery will have in Gross Profit.

This is also referred to as the “Crack Spread”. Sure, that Gross Profit will be decreased by the other expenses which keep the facilities running, resulting in their final “Net Profits”, but they know what those costs are going to be. So, the Crack Spread ultimately determines what their Net Profits are going to be.

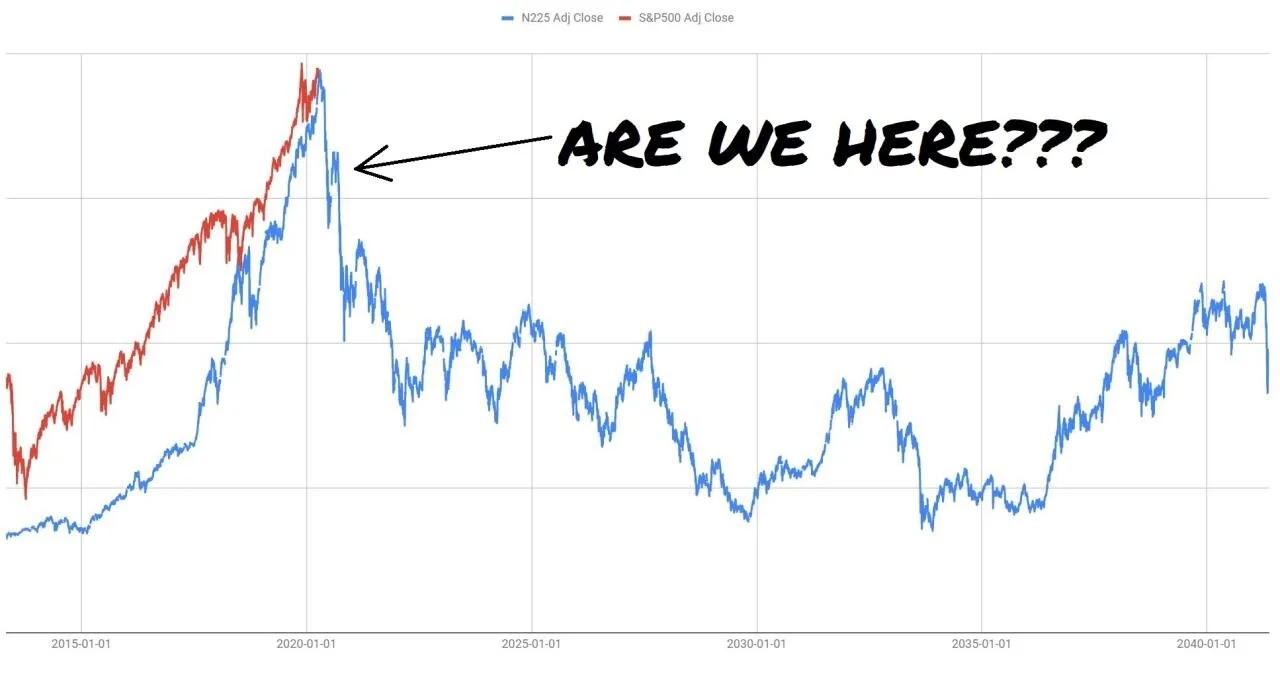

Oil and gasoline prices are all over the place, though, right?

Yes, they can be extremely volatile. So, it is difficult to know how high or low that Crack Spread is going to be at any point in time. This is because many variables factor into those prices, including: local and seasonal factors, the time of year, the weather, global supplies, global demand, production economics, production disruptions, operational efficiencies, environmental regulations, hurricanes, geopolitics, etc. It takes experts many years to understand the finer points of how these prices are affected because there is so much going on in the world that it gets quite difficult to forecast with any real certainty.

Although Oil Refineries can reliably predict their own operational costs, they cannot predict the cost of crude oil or the price they’ll receive from the gasoline that they produce. An uncertain Crack Spread clouds their ability to understand their true financial exposure. Without some protection, they wouldn’t be able to guarantee that they would earn any money at all after each year of work!

So, how would they go about mitigating these risks?

Futures Contracts

Futures contracts are used as an insurance policy for the Oil Refineries’ Gross Profit.

If you know about futures contracts, you’ll understand that the Oil Refinery can lock in the price of the crude oil that they will be buying in the future (up to many years in advance), simply by buying crude oil futures contracts. Additionally, they can lock in the price of the gasoline that they will be selling in the future (also up to many years in advance), simply by selling gasoline futures contracts. This is referred to as “hedging”.

Simply: They pre-purchase the oil, similar to buying the newest version of an iPhone before it is released, and they pre-sell their gasoline in the same way.

By using these Futures Contracts to lock in their Gross Margins, they produce stability for their stakeholders. However, Futures Contracts are a “zero-sum” trade - meaning that one side makes money while the other loses money. Refineries are comfortable with this setup, knowing that half of the time they will lose money that they’d have gained due to lower costs, simply because they want to create stability and remove the risk that the other half of the time they would lose money due to higher costs. They are in it for the stability.

However, this doesn’t “freeze” the Crack Spread itself. The refinery just pre-purchased their crude oil, and pre-sold their gasoline. The Crack Spread itself continues to go up and down. However - for each refinery independently - their Gross Profit is already known ahead of time because they’ve already locked in the price that they will be paying for their Crude Oil in the future and they’ve locked in the price that they will be selling their gasoline in the future.

Here’s why that matters to you:

In their effort for stability, they will only lock in their Gross Margins if the Crack Spread is currently at a price that will guarantee profitability in the future. Thus, they are always working to “fix” the price of the Crack Spread, directly or indirectly, and adjusting their operations to make sure that the Crack Spread is always at a reasonable price.

“Essentially, refiners want a strong positive spread between the price of a barrel of oil and the price of its refined products; meaning a barrel of oil is significantly cheaper than the refined products.”

Just understand that this process allows speculators to take advantage of this situation and earn loads of money.

Speculators provide the liquidity needed by Oil Refineries. Without speculators willing to assume that price risk, the Refineries wouldn't be able to budget effectively. The economic purpose served by hedging is to contain price risk which ultimately means consumers pay less for goods.

The trick is to only participate in this Crack Spread at the times when the Oil Refineries would have made more money if they didn’t hedge.

*Note: There is a way to take advantage of this using ETF’s as well, if you do not wish to use futures contracts, although it isn’t as precise and doesn’t receive nearly as high of a return. Or even as a market signal for investing in Oil Refinery companies directly. More about those in future articles (sign up for updates near the bottom of the article).

So, what do Oil Refineries do in the situations where the Crack Spread is really expensive or really cheap to get the price to change direction?

If the Crack Spread is low, Oil Refineries will be taking actions that drive the price back up (such as decreasing their operations) and if the Crack Spread is high, Oil Refineries will be taking actions that drive the price back down (such as hedging the Crack Spread with futures contracts).

So, Refineries will be helping me make money?

Yes. But, remember, there is a Den of Wolves under that Money Tree! There are a large number of risks that could cause the Crack Spread to temporarily jump up a few dollars, or even drop a few dollars - quite suddenly! And, that could certainly cause you to lose a significant amount of money as well! You must know what potential pitfalls await you, and how to protect yourself from these risks.

However, if you are aware of those risks, and you end up picking the best times to enter the Crack Spread, then you should be receiving portfolio returns of 55% or more per year (yes, fifty-five percent). The trades themselves can exceed 800% per position (eight-zero-zero).

Think of it like “siphoning” profits out of the Oil & Gasoline industry by helping to bring prices closer to where they should be - a form of futures arbitrage.

Arbitrage exists as a result of market inefficiencies and arbitragers both exploit those inefficiencies and resolve them.

How much Money can you make from the Crack Spread?

Image courtesy of Bradley Urias

Cost of Entering the Crack Spread

When you buy a share of stock you have to pay money to receive the share of stock. Lets say that a share of XYZ Corp costs $100. In that case, you pay the $100 and you get a share of stock. If you want to have cash again, then you will have to sell your share of stock - and, depending on what it’s price is at the time that you sell it, you get some cash back. That could be more or less than the $100 that you paid.

It doesn’t work that way with futures contracts.

With futures contracts, you don’t actually pay anything for the contracts themselves (you may need to pay a small brokerage fee to buy it or sell it, but that is likely just a couple of dollars). With futures contracts, you are required to deposit only a fraction of the money into a “margin account” (usually 3-12%) to guarantee that you can withstand a loss if it loses value. If it does, they’ll pull money out of that account and you may be required to deposit more if it drops too low. If it goes up in value, the margin account value simply goes up. When you exit your position the money is moved out of the margin account and into your primary account.

In the case of the Crack Spread, that original margin deposit can be as low as $1,250 - but it can be around $3,000 or even higher if your account doesn’t have much capital.

Photo by olia danilevich from Pexels

Potential Profits from the Crack Spread

Every single dollar that the trade moves is worth $1,000.

So, if you buy the Crack Spread at $25, and then it moves up to $30 and you close your position, you’d have made $5,000. If you bought 2 spreads, you’d have made $10,000. I typically buy 20 - but, I have bought over 200 before for some of my private clients (yes, that would mean $1 Million in profits in this example).

Considering that you only need to have about $1,250 set aside for margin to enter one of these Crack Spreads, a single $1 move upwards would be an 80% return on your investment. But, if it drops by $1, it would give you a loss of 80% instead.

Additionally, in the case of the loss, your “margin account” would drop in value to $250 and you may be required to deposit additional money to bring your margin account back up to $1,250 OR be forced to exit out of your Crack Spread.

Remember, you really need to know what to look for to reduce your chances of a loss. You only want to go for the “sure-thing” if you can. If you don’t do it right, you could lose a lot very quickly! That’s why the Getting Started Guide is so valuable!

SO MANY PEOPLE THAT I’VE TALKED TO WITH THIS TRADE JUST WANT TO BE IN IT ALL THE TIME. THEY JUST FALL IN LOVE WITH THE MONEY TREE SO HARD THAT THEY DON’T CARE IF THERE ARE WOLVES AROUND OR NOT. EVENTUALLY, THEY GET EATEN ALIVE! DON’T DO THAT!!!

In my experience, the “perfect scenario” presents itself about 2-3 times per year, and by using an initial allocation of $10,000 - your patience and safety will help you turn that $10,000 ( 8 trades, $1,250 deposit per trade ) into $18,000 and then ( with 14 more trades as you now have enough to cover a $17,500 deposit total ) into $32,000. An annual return of 220%. And that is assuming that the trade only increases by $1 both times.

When I enter this trade, I typically exit after the Crack Spread has gone up by $2-$3, but - when the market gets really wonky - I can get more than a $5 move upwards per trade!

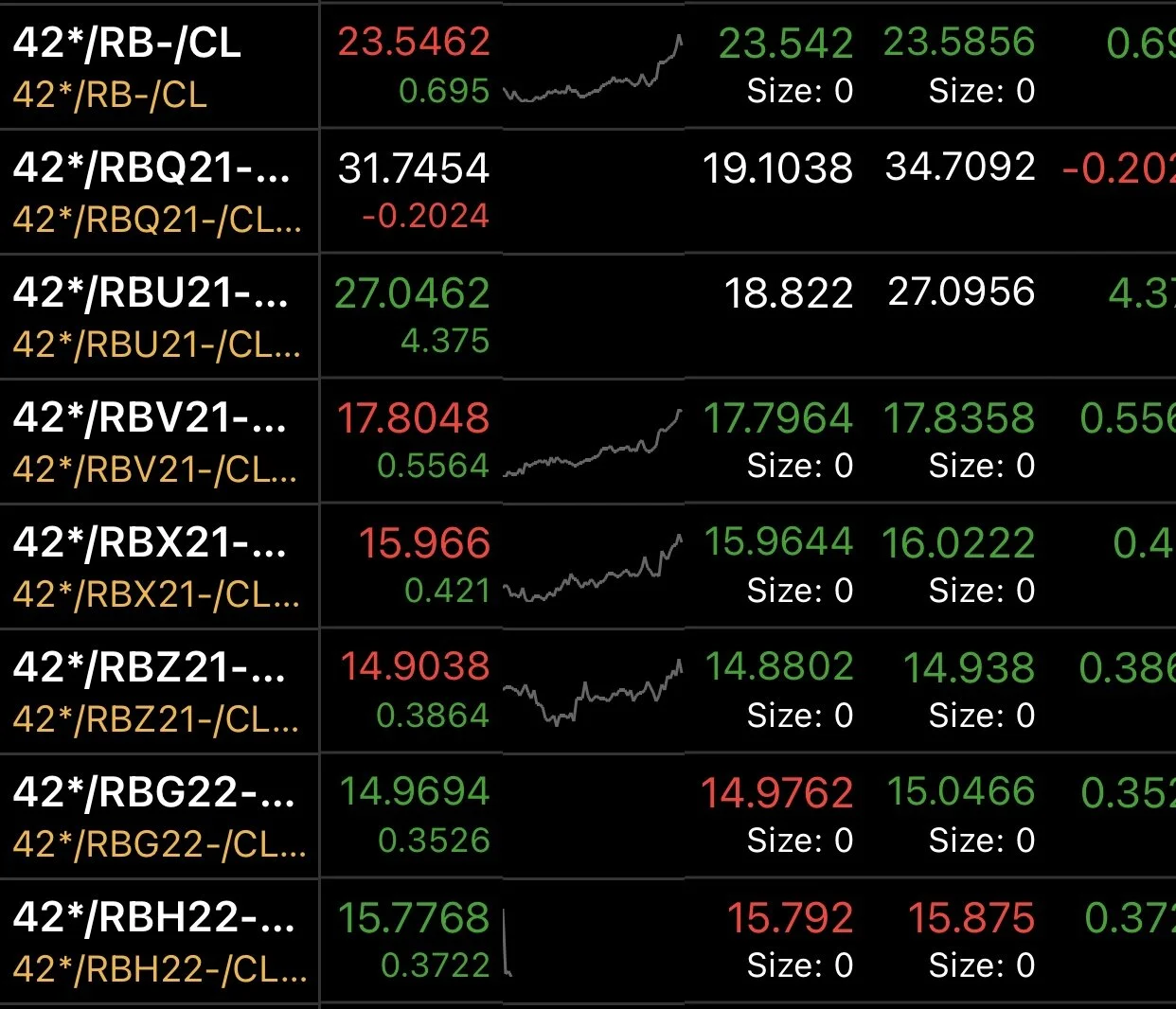

In the example I gave earlier in this article - near the beginning - I suggested a Crack Spread of $23. I wouldn’t be too surprised if the trade dropped to $22. Could it raise to $24? Sure. But having confidence in that requires knowing a bit more about the oil market, geopolitics, and the global economy. You really need to learn as much on your own before going into this spread - but, we’ve provided those details below as well.

Congratulations! You are now officially introduced to the Crack Spread.

How You can Make Money from the Crack Spread

Learn to Trade the Oil-Gasoline Crack Spread On Your Own

You can make money with this trade by learning all of the important information on your own. The 3 steps that you absolutely must know if you want to trade it on your own: futures contracts, oil & energy markets, and the oil-gasoline crack spread itself.

All you’ll need to do is:

1) Spend the time to read and understand all of the material on your own,

2) Learn how to set up your accounts and charts, and

3) Practice trading the Crack Spread as much as possible in a simulator before making live trades.

We’ve made steps 2 and 3 very simple with the Getting Started Guide, and provided all the best reading material below for the first step.

Futures Contracts

“What is a Futures Contract?” - If you don’t know, you really need to know. Not understanding futures contracts is the number one way to meet the whole den of wolves when you try to trim the money tree. So, for that reason, check out this concise Investopedia article and video and then read up on the following material to get serious. This spread simply is NOT for people who don’t understand how futures contracts work.

NFA’s guide “Opportunity and Risk: An Educational Guide to Trading Futures”

CME: Why Smart Money Trades Spreads—A Three-Part Series

The Oil Industry

The Oil industry is basically what the entire world operates on. I’d like nothing more than for this to change, but for now - understand that trying to trade the Crack Spread without knowing anything about the oil industry is like trying to teach your grandmother how to use a computer with just verbal communication. The more knowledge of the Oil Markets and the Refineries that you have, the better - in my humble opinion. The best place to start is by picking up the Oil 101 book - a favorite for traders in the energy industry. If you only bought one book, that one would be it. But, there are others that can expand upon that information with more specific backgrounds and even current events.

Read the Oil 101 Book

Follow the Bloomberg Energy Sector News

Crude Volatility: The History and the Future of Boom-Bust Oil Prices

To give you further insight into the past and future of the oil industry, consider reading these books as well:

The Quest: Energy, Security, and the Remaking of the Modern World

The World For Sale: Money, Power, and the Traders Who Barter the Earth's Resources

The Crack Spread

I’ve explained the basic concept of this trade to you above, but you should also know that there’s a huge correlation between the prices of crude oil and the refined products, and that - to make it easier for refineries to operate - the Crack Spread receives a VERY generous spread credit for margin purposes so you don’t need to put up much money at all to make the trade.

Translation: The potential returns can be far higher because this futures spread is more leveraged than those of Stock Options and other Futures Contracts. That being said, there is also more risk if you don’t know what you are doing.

To get a more in-depth understanding of the Crack Spread, read these:

The Chicago Mercantile Exchange’s Introduction to Crack Spreads

Modelling and Trading the Gasoline Crack Spread: A Non-Linear Story

HOWEVER, DO NOTE THAT THE OGCS GETTING STARTED GUIDE IS ONLY DESIGNED TO GET YOU STARTED.

Additional Information

If you plan to sell futures contracts to clients: Get your FINRA Series 3 License - it is REQUIRED.

If not, it’s still a great gauge to test your understanding of futures contracts (which is 1 of the 3 important steps to learn to trade this spread on your own)

NOTE BY EAT WANDER EXPLORE: This article was written by Bradley Urias. Bradley has pursued a Masters in Financial Engineering, completed an MBA in Finance, and passed the Chartered Financial Analyst level 1 exam. He has experience working in Private Equity and as an Investment Manager for over 10 years, where he had many private clients. He is currently retired and has been traveling the world with his family since early 2018. He is 39 years old.

FAQ’s

What is the difference between WTI and Brent crude oil?

WTI and Brent are two of the most commonly traded crude oil benchmarks in the world. They represent different qualities and prices of crude oil from different regions. WTI stands for West Texas Intermediate, which is a light and sweet crude oil produced in the U.S. Brent stands for Brent Blend, which is a blend of crude oil from the North Sea. WTI is typically more expensive than Brent because it is easier to refine and transport¹.

How does the crack spread affect the price of gasoline at the pump?

The crack spread is one of the factors that affect the price of gasoline at the pump. The crack spread reflects the profit margin of the refiners who buy crude oil and sell refined products such as gasoline. When the crack spread is high, it means that the refiners can make more money from selling gasoline than buying crude oil. This can encourage them to produce more gasoline and lower the price at the pump. Conversely, when the crack spread is low, it means that the refiners are making less money from selling gasoline than buying crude oil. This can discourage them to produce less gasoline and raise the price at the pump²³.

What are some of the factors that influence the crack spread?

The crack spread is influenced by various factors such as supply and demand, seasonality, weather, geopolitics, regulations, and market expectations. For example, the demand for gasoline tends to increase in the summer when people travel more, which can widen the crack spread. The supply of crude oil and refined products can also fluctuate depending on the production levels, inventories, imports, exports, and disruptions such as hurricanes, wars, or sanctions. The crack spread can also change depending on the environmental and safety regulations that affect the quality and specifications of the refined products. Finally, the crack spread can be affected by the market expectations and sentiments of the traders and investors who buy and sell futures and options contracts on crude oil and refined products⁴⁵.

(1) Crack Spread: What it is, How to Trade It - Investopedia. https://www.investopedia.com/terms/c/crackspread.asp.

(2) RBOB Gasoline Crack Spread Quotes - CME Group. https://www.cmegroup.com/markets/energy/refined-products/rbob-crack-spread-swap-futures.html.

(3) An introduction to crack spreads - U.S. Energy Information .... https://www.eia.gov/todayinenergy/detail.php?id=1630.

(4) Low U.S. gasoline demand is making gasoline less profitable, reducing .... https://www.eia.gov/todayinenergy/detail.php?id=60862.

(5) 3:2:1 Crack Spread - U.S. Energy Information Administration (EIA). https://www.eia.gov/todayinenergy/includes/crackspread_explain.php.

Found this post useful? You can buy us a coffee to help support the site’s running costs. Alternatively, please support the site by sharing this post with your friends, following along on Instagram, or signing up for the free Eat Wander Explore weekly newsletter.

Disclosure About My Experience & Recommendations

I invest primarily in the Crack Spread. It is MY MOST PREFERRED investment strategy. However, it is not a typical investment strategy. It does not contain the purchase or sales of stocks, bonds, mutual funds, exchange traded funds (ETF’s), or stock options. It is highly leveraged, as it uses derivatives called “futures contracts”. Specifically, this strategy consists of the purchase of a gasoline futures contract and the sale of a crude oil futures contract, and occasionally futures options on those contracts.

This strategy is considered a “hedging” strategy as it uses one long position and one short position. Despite how rare it is for people to trade futures contracts, the majority of the people who do are simply buying and selling specific contracts, while a few trade in spreads between the same contracts (usually between two different months). The specific strategy that I use is even more rare - there are only a handful of smaller companies and individuals who use it - and it involves different, but related, contracts.

I’ve been trading the Crack Spread since 2010. I have lost money many times, especially in the beginning - and occasionally quite a lot. It took me about 5 years to really understand some of the unique risks involved with this trade, and about 8 years to solidify consistent returns from it without having any more major hits. That being said, it was worth the 8 years of ups and downs. It is now my only real income source, and it produces far more income than any other job that I’ve ever had.

That being said, it is still super important to use it SAFELY, in a strategy that does not put your vital living expenses at risk. That’s why I wrote a (rather bland) article about portfolio management strategies as well - it is worth reading! Here it is:

Image courtesy of Bradley Urias

Thank you VERY much for reading our article. We actually created this website to help people reach financial independence. Did you know that by having a remote job and traveling endlessly, or living in a country that has low costs of living, you can actually reach retirement quicker? Plus, retirement abroad is up to 75 percent cheaper as well! Learn more by exploring our website: EatWanderExplore and REmotiFIRE.

See our Thank You page to sign up for our free weekly newsletter - you’ll receive only 1 email per week letting you know about our latest travel articles, remote-work life, and amazingly affordable destinations!

Found this post useful? Buy us a coffee to help support this site’s running costs OR share this article with a friend.

![Tech Elevator Demystified: Reviews, Legitimacy, and Winning Alternatives [2024]](https://images.squarespace-cdn.com/content/v1/5a028c7bbce1766d207a8a6f/1707008329038-96GH4TTYZATP6N3WDWXR/tech_elevator.png)

![Cracking the Code: Coding Dojo Reviews, Legitimacy Check, and Top Alternatives [2024]](https://images.squarespace-cdn.com/content/v1/5a028c7bbce1766d207a8a6f/1707007756149-VSJNN2PHHX2RWK6RSVQM/coding_dojo.png)

![App Academy Unveiled: Reviews, Legitimacy Check, and Top Alternatives [2024]](https://images.squarespace-cdn.com/content/v1/5a028c7bbce1766d207a8a6f/1707008090320-IUIIV4T416FP5ILRGK5W/app_academy.png)

![CareerFoundry Decoded: Reviews, Legitimacy, and the Best Alternatives [2024]](https://images.squarespace-cdn.com/content/v1/5a028c7bbce1766d207a8a6f/1707008030234-CZTE1805JUCU2M2GK7RO/careerfoundry.png)